> Story by Homestead Staff

> Photography by Latham Jenkins

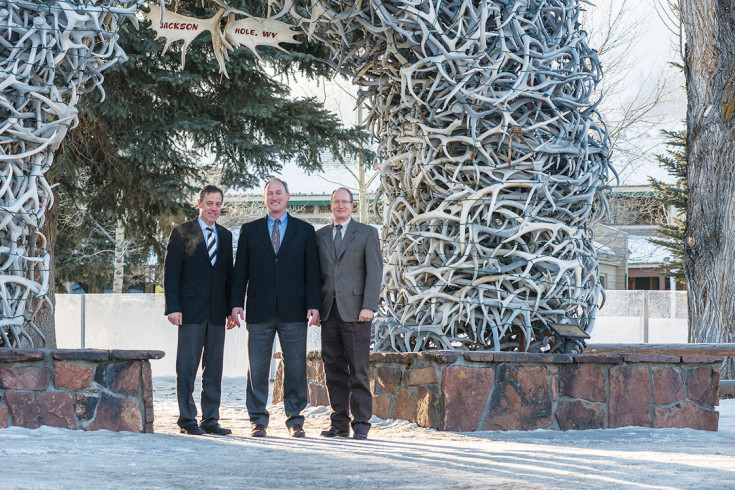

Jim Ryan, President

David Perino, Executive Vice President

• No state personal or corporate income tax

• No state inheritance tax

• No state gift tax

• No state tax on retirement income

• No state franchise or excise tax

• No state tax on real estate sale proceeds

• Low real estate property tax

• No state tax on mineral interest ownership

• No state tax on intangibles

Charming? Sure. But that does not explain why high-end clients from New York to California choose to live here. They do because Jackson is not your typical small town, no more than Jackson Hole is your typical valley. What small American town offers such a cross section of cosmopolitan retail, fine dining, savvy investment, and world-class architectural design? In just the same way, BOJH is not a “small-town bank,” but rather a highly efficient, sophisticated community institution that embraces and maximizes the potential of

its location.

Why Wyoming?

With 17 years of legal experience enhancing his financial leadership, Clay Geittmann, BOJH’s senior vice president and trust officer, is well aware of the unique benefits Wyoming offers his clients. Given its robustly pro-business statutes and lack of income tax, Wyoming regularly attracts consideration from those contemplating where they want to live.

“When you look at states that don’t have income tax, and then look at the statutory benefits and quality of life available in those states,” Geittmann explains, “Wyoming stands as not only a great place to live but also an incredible place to do business.”

But favorable laws alone do not ensure financial success. What is needed is a team whose specialized knowledge of these advantages can help individuals to capitalize on such opportunities. Geittmann’s team of trust and wealth management professionals knows the local terrain as well as the global markets. Speaking of banking expertise, BOJH’s top six senior managers each have lived in Jackson for over 15 years, giving the team 132 years of local banking experience—experience that merges knowledge of Wyoming’s special advantages with that of the wider financial world.

Why Bank of Jackson Hole?

Jackson Hole attracts people like no other place in America. This financial team has therefore learned to meet the needs of a variety of clients, whether third-generation residents or new residents, as well as those considering residency. When joining a new community, these are exactly the sorts of specialists you want in your corner to smooth the transition.

“We’re able to provide a tailored package that fits the needs of the client, created by a local team focused on building relationships at a level of customized service that is difficult for regional and national firms to deliver,” says Geittmann. Being able to bank with your neighbors—and not a press-by-number phone tree—adds to Jackson Hole’s appeal as a place that melds culture, amenities, civic engagement, and scenic beauty. For mortgages, for business lending, for sound advice, the BOJH team provides an approachable face for a sophisticated enterprise that can facilitate large deals while providing the same cutting-edge service as any bank in the country.

For example, when customers talk to a BOJH lender, they are talking to someone who is part of the decision-making process; as a result, the lender will work to help the customers reach their objectives. Because decisions are made with a board of fellow local experts who know the market and valley better than anyone, service is attentive, timely, and efficient.

Peter Lawton, CEO of BOJH, summarizes the bank’s mission by stating, “Bank of Jackson Hole’s focus is to reinvest in our community; our time, our talent, and our money remain where they should—locally.” Since its founding in 1982, the bank has been a visible and highly respected pillar of this community—our community.

Jackson Hole is like nowhere else in the world, and Bank of Jackson Hole fits right in.